Some Known Details About Bankruptcy Australia

Wiki Article

The Single Strategy To Use For Bankruptcy Bill

Table of ContentsThe 10-Minute Rule for Bankruptcy AustraliaTop Guidelines Of Bankruptcy AustraliaExamine This Report on Bankruptcy CourtAll about Bankruptcy Australia10 Easy Facts About Bankruptcy Bill ShownNot known Incorrect Statements About Bankruptcy Attorney Near Me

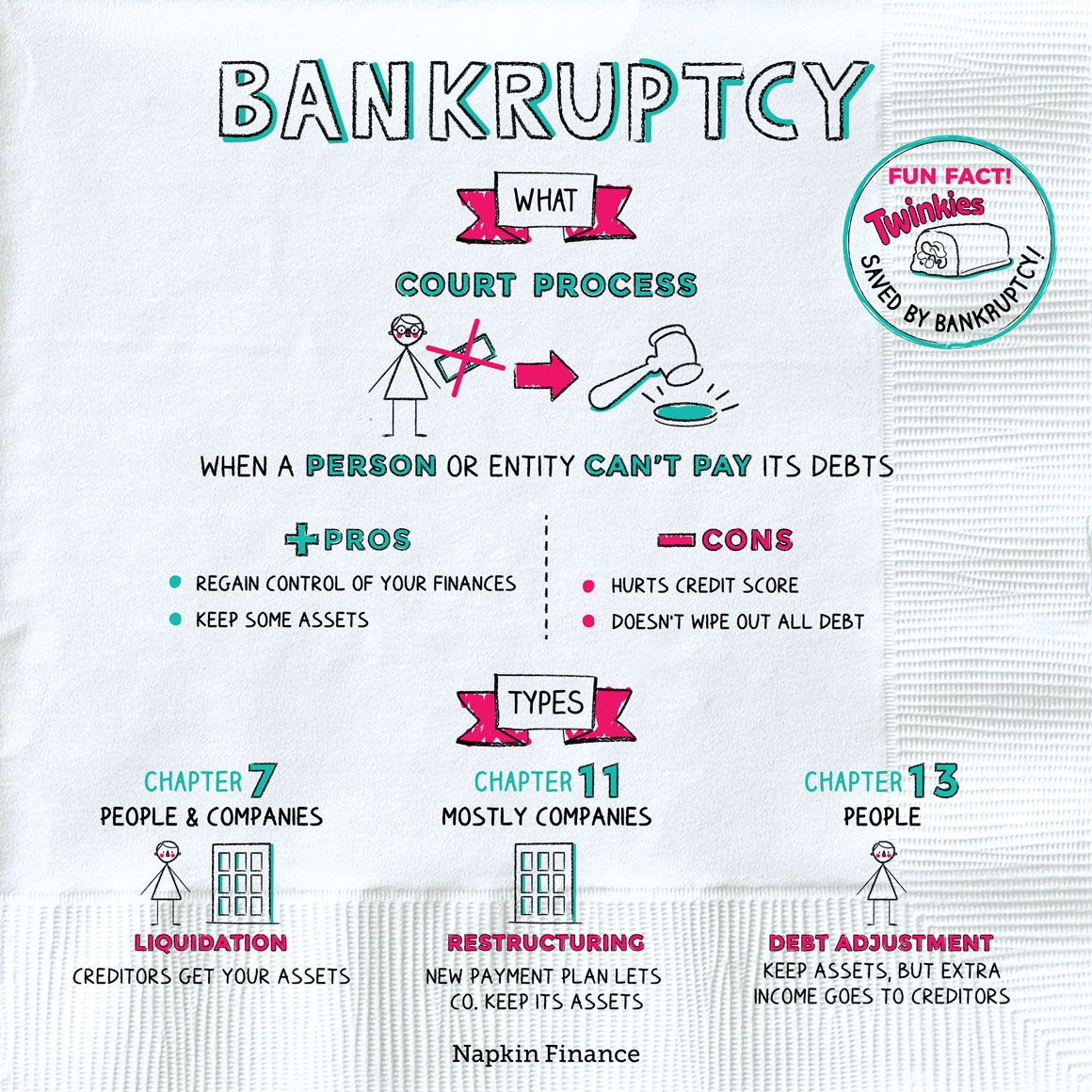

Nevertheless, the two types of bankruptcy ease financial debt in various methods. Chapter 7 personal bankruptcy, also called "straight bankruptcy," is what the majority of people most likely think of when they're considering applying for insolvency. Under this kind of personal bankruptcy, you'll be required to permit a federal court trustee to monitor the sale of any possessions that aren't excluded (cars, work-related tools as well as standard house home furnishings might be excluded).Here are several of the most common and important ones:: This is the person or firm, selected by the personal bankruptcy court, to act on part of the creditors. He or she examines the borrower's petition, liquidates home under Chapter 7 filings, and distributes the earnings to financial institutions. In Phase 13 filings, the trustee likewise looks after the borrower's settlement strategy, obtains payments from the borrower and disburses the cash to creditors.

Once you've submitted, you'll also be needed to complete a program in personal financial monitoring before the insolvency can be discharged. Under specific scenarios, both needs could be waived.: When bankruptcy process are full, the personal bankruptcy is taken into consideration "released." Under Chapter 7, this occurs after your possessions have actually been sold and lenders paid.

Bankruptcy Lawyers Near Me - The Facts

The Insolvency Code calls for individuals who desire to file Chapter 7 insolvency to demonstrate that they do not have the ways to repay their financial obligations. The demand is intended to cut misuse of the insolvency code.If a borrower stops working to pass the methods examination, their Phase 7 personal bankruptcy might either be disregarded or converted into a Phase 13 proceeding. Under Chapter 7 insolvency, you may consent to proceed paying a debt that can be discharged in the proceedings. Reaffirming the account and also your dedication to pay the financial obligation is normally done to allow a borrower to keep an item of security, such as an auto, that would or else be seized as component of the insolvency procedures.

Insolvencies are considered unfavorable information on your debt record, as well as can influence how future loan providers see you - bankruptcy lawyers near me. Seeing a personal bankruptcy on your credit score data may trigger creditors to decline prolonging you credit rating or to provide you greater rate of interest prices and also much less favorable terms if they do determine to provide you credit history.

Bankruptcy Australia for Dummies

Personal bankruptcy information on your credit scores report might make it very difficult to get additional credit score after the insolvency is discharged at least till the info cycles off your debt report.Study financial debt loan consolidation car loans to see if consolidation can decrease the complete amount you pay and also make your debt much more workable. Back-pedaling your financial obligation is not something your lenders wish to discover this see occur to you, either, so they may want to collaborate with you to set up a much more possible payment strategy.

Unknown Facts About Bankruptcy Benefits

Monitoring your credit rating record. Creating and also sticking to a personal spending plan. Making use of credit in tiny methods (such as a safeguarded charge card) and paying the balances completely, ideal away.Personal bankruptcy is a legal case initiated when an individual or organization is incapable to pay back arrearages or responsibilities. The personal bankruptcy process begins with a petition submitted by the borrower, which is most typical, or in support of lenders, which is much less usual. All of the borrower's properties are gauged as well as evaluated, as well as the possessions might be utilized to settle a portion of the outstanding debt.

All personal bankruptcy cases in the United States are dealt with via federal courts. Any decisions in federal bankruptcy cases are check this made by an insolvency judge, consisting of whether a borrower is eligible to file and also whether they need to be released of their financial debts. Management over bankruptcy cases is typically handled by a trustee, an officer appointed by the USA Trustee Program of the Department of Justice, to stand for the borrower's estate in the case.

Things about Bankruptcy Bill

Their liked shareholders, if any type of, may still receive settlements, though usual shareholders will not. A housekeeping business declaring Chapter 11 personal bankruptcy may enhance its prices somewhat and supply more solutions to end up being successful. Chapter 11 insolvency permits business to continue conducting its company tasks without interruption while servicing a debt settlement strategy under the court's supervision.Chapter 12 insolvency supplies relief to family ranches and fisheries. They are permitted to preserve their companies while working out a strategy to repay their debts. Phase 15 personal bankruptcy was included to the law in 2005 to deal with cross-border cases, which include borrowers, properties, lenders, and other celebrations that might be in greater than one nation.

Not all financial debts qualify to be discharged. A few of these include tax insurance claims, anything that was not detailed by the borrower, youngster support or alimony payments, injury financial obligations, and also financial debts to the federal government. Additionally, any type of secured creditor can still apply a lien versus home owned by the debtor, gave that the lien is still valid.

Bankruptcy Business Things To Know Before You Get This

When a petition for personal bankruptcy has actually been submitted in court, lenders obtain a notification and also can object if they pick to do so. If they do, they will certainly require to file a problem in court prior to the due date. This brings about the declaring of an adversary continuing to recover money owed or apply a lien.Report this wiki page